The Ultimate Guide To Largest Retirement Community In Florida

Attained Age Vs Issue Age Can Be Fun For Everyone

Table of ContentsTop Guidelines Of Attained Age Vs Issue AgePlan G Medicare Things To Know Before You BuyThe Ultimate Guide To Boomerbenefits Com ReviewsThe Aarp Medicare Supplement Plan F IdeasThe Best Guide To Boomerbenefits Com Reviews8 Simple Techniques For Boomerbenefits Com Reviews

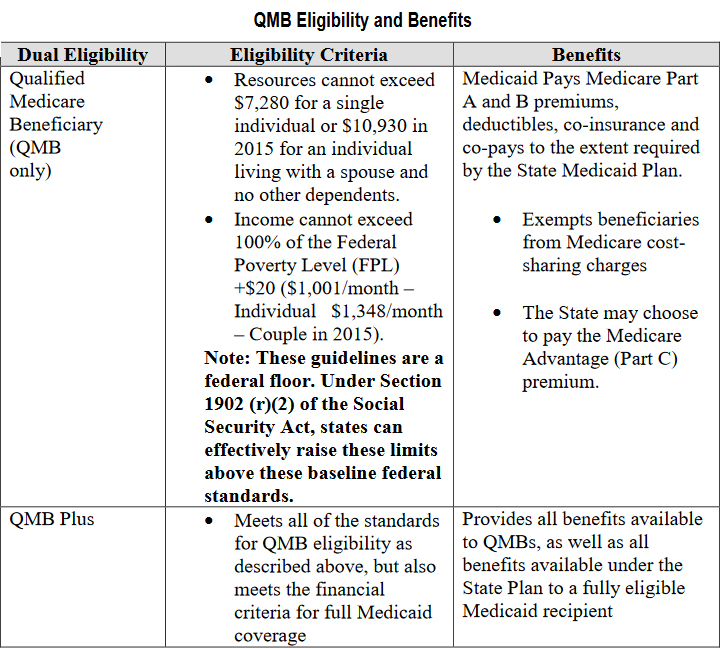

50 of the $185 accepted price, service provider will with any luck not be discouraged from offering Mary or various other QMBs/Medicaid receivers. - The 20% coinsurance is $37. Medicaid pays none of the coinsurance due to the fact that the Medicaid rate ($120) is reduced than the quantity the company currently received from Medicare ($148) - boomerbenefits.com reviews. For both Medicare Benefit and also Original Medicare, if the expense was for a, Medicaid would certainly pay the full 20% coinsurance regardless of the Medicaid price.If the service provider desires Medicaid to pay the coinsurance, then the provider has to register as a Medicaid supplier under the state guidelines. This is an adjustment in policy in carrying out Section 1902(n)( 3 )(B) of the Social Safety Act (the Act), as changed by area 4714 of the Well Balanced Budget Act of 1997, which bans Medicare providers from balance-billing QMBs for Medicare cost-sharing.

QMBs have no lawful responsibility to make additional repayment to a service provider or Medicare took care of care strategy for Part A or Component B expense sharing. Suppliers that inappropriately expense QMBs for Medicare cost-sharing are subject to assents.

CMS advised Medicare Advantage plans of the regulation against Equilibrium Invoicing in the 2017 Call Letter for strategy renewals. See this excerpt of the 2017 call letter by Justice in Aging - It can be difficult to show a provider that is a QMB. It is specifically difficult for suppliers that are not Medicaid service providers to determine QMB's, given that they do not have access to on the internet Medicaid qualification systems If a customer reports a balance billng problem to this number, the Customer Service Associate can intensify the problem to the Medicare Administrative Service Provider (MAC), which will certainly send out a compliance letter to the carrier with a copy to the customer.

The Main Principles Of Largest Retirement Community In Florida

These adjustments were scheduled to go right into impact in October 2017, yet have been delayed. Find out more about them in this Justice in Aging Problem Quick on New Methods in Fighting Improper Invoicing for QMBs (Feb. 2017). (by mail), also if they do not also obtain Medicaid. The card is the system for health treatment service providers to bill the QMB program for the Medicare deductibles and also co-pays.

A consumer who has a trouble with financial obligation collection, might additionally send a complaint online or call the CFPB at 1-855-411-2372. TTY/TDD individuals can call 1-855-729-2372. need to complain to their Medicare Advantage plan. In its 2017 Phone call Letter, CMS emphasized to Medicare Benefit specialists that government guidelines at 42 C.F.R.

Links to their webinars and also other resources goes to this web link. Their info includes: September 4, 2009, updated 6/20/20 by Valerie Bogart, NYLAG This short article was authored by the Empire Justice.

Thus, members must undergo a redetermination to continue obtaining advantages for the following year. This procedure includes supplying your local Medicaid office with updated info about your month-to-month earnings and also overall resources. If someone does not have Part A but is eligible, they can choose to join anytime throughout the year.

The Facts About Boomerbenefits Com Reviews Uncovered

The very first step in enrollment for the QMB program is to figure out if you're qualified. A quick and visit our website also simple method to do this is to call your regional Medicaid workplace - largest retirement community in florida. The following step is to finish an application (aarp plan g). You can request Medicaid to provide you with an application or situate a QMB program application from your state online.

There are instances in which states might limit the amount they pay healthcare carriers for Medicare cost-sharing. Even if a state restricts the amount they'll pay a service provider, QMB participants still don't need to pay Medicare companies for their healthcare costs and it's against the legislation for a carrier to inquire to pay.

Typically, there is a costs for the plan, however the Medicaid program will certainly pay that premium. Several individuals select this added protection since it supplies routine oral and also vision treatment, and also some come with a gym membership.

The 6-Second Trick For Largest Retirement Community In Florida

Enter your postal code to draw strategy choices readily available in your location. Select which Medicare intends you wish to contrast in your area. Compare prices alongside with strategies & providers offered in your area. Jagger Esch is the Medicare expert for Medicare, FAQ as well as the founder, president, and also CEO of Elite Insurance Coverage Partners and also Medicare, FAQ.com.

He is included in many publications as well as writes regularly for various other skilled columns regarding Medicare.

Numerous states enable this throughout the year, however others restrict when you can enlist partly A. Keep in mind, states make use of different rules to count your revenue and properties to figure out if you are qualified for an MSP. Examples of revenue include incomes as well as Social Security benefits you obtain. Examples of assets consist of examining accounts as well as supplies.

The smart Trick of Attained Age Vs Issue Age That Nobody is Discussing

20 for each brand-name medicine that is covered. Extra Aid only uses to Medicare Component D.

If you're signed up in the QMB program, the complying with pointers will certainly aid ensure that your healthcare prices are covered: Allow a medical care specialist recognize that you're enrolled in the QMB program. Program both your Medicare and also Medicaid cards or QMB program card at any time you seek care. If you receive a bill that should be covered by the QMB program, call the medical care specialist.

Different states may have various means to determine your revenue as well as resources. Let's analyze each of the QMB program qualification standards in more information below.

Largest Retirement Community In Florida Can Be Fun For Anyone

, the source limits for the QMB program are: $7,970 $11,960 Source limitations additionally raise every year. As with revenue limitations, you must still use for the QMB program if your sources have actually a little increased.